Debt Consolidation vs Bankruptcy: Understanding Which Option Provides Real Relief

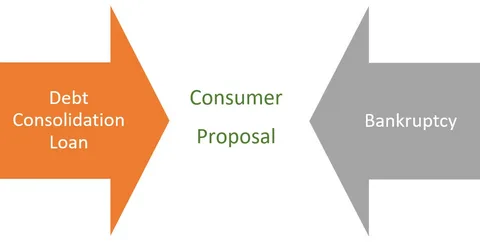

When financial obligations become difficult to manage, many people begin searching for solutions that promise simplicity and relief. Two of the most commonly discussed options are debt consolidation and bankruptcy. While both approaches aim to address overwhelming debt, they function very differently and produce distinct legal and financial outcomes. Understanding these differences is essential before making decisions that affect future stability. For individuals in Clearwater evaluating their options with a bankruptcy attorney, clarity is critical before committing to either path.

How Debt Consolidation Works in Practice

Debt consolidation typically involves combining multiple debts into a single payment. This is often done through a consolidation loan, balance transfer credit card, or third-party program that negotiates payments on the consumer’s behalf. The goal is to simplify repayment and, in some cases, reduce interest rates.

While consolidation can be helpful in limited situations, it does not eliminate debt. Creditors must still be paid in full, and missed payments can lead to additional fees, higher interest, or renewed collection activity. In many cases, consolidation relies heavily on the borrower’s credit score and income stability. Without those factors, approval may be difficult or expensive.

Another consideration is that debt consolidation does not provide legal protection from creditors. Lawsuits, wage garnishments, and collection calls may continue if payments are missed or agreements fail.

The Legal Structure of Bankruptcy Relief

Bankruptcy is a court-supervised process governed by federal law. Unlike consolidation, bankruptcy provides enforceable legal protections and defined outcomes. Once a case is filed, most collection activity must stop due to the automatic stay. This legal safeguard creates immediate relief from creditor pressure.

Depending on the type of bankruptcy filed, qualifying debts may be discharged or reorganized into a structured repayment plan. This process creates certainty. Individuals know which debts will be addressed, what payments are required, and when the case will conclude.

Bankruptcy is not dependent on negotiating with individual creditors. Instead, it applies uniform rules that ensure fairness and transparency for all parties involved.

Comparing Costs and Financial Impact

Debt consolidation often appears less severe on the surface, but it can become costly over time. Interest, service fees, and extended repayment periods may increase the total amount paid. Additionally, failure to comply with consolidation terms can worsen financial conditions.

Bankruptcy involves court filing fees and legal costs, but it also offers defined relief. Often, individuals pay less overall by discharging qualifying debts rather than extending repayment indefinitely. The financial impact is clearer and more predictable.

Credit effects also differ. While both options affect credit, bankruptcy provides a structured opportunity to rebuild after resolution. Consolidation may prolong financial strain if debts remain unresolved.

Risk Factors and Common Misconceptions

A common misconception is that debt consolidation is always safer than bankruptcy. In reality, consolidation carries significant risk when income is unstable or debt levels are high. Missed payments can quickly undo any perceived benefit.

Another misconception is that bankruptcy permanently limits financial opportunities. In truth, bankruptcy establishes a legal endpoint. Once debts are resolved, individuals can focus on rebuilding without the constant burden of past obligations.

Understanding these realities helps consumers avoid solutions that delay relief rather than provide it.

Frequently Asked Questions About Debt Consolidation and Bankruptcy

Is debt consolidation better for credit than bankruptcy?

Not always. Missed payments or account defaults may damage credit after consolidation.

Can creditors still sue after consolidation?

Yes. Consolidation does not prevent legal action if agreements fail.

Does bankruptcy eliminate all debts?

Some debts may not qualify for discharge and require separate review.

Is bankruptcy only for extreme cases?

Bankruptcy is designed to help individuals regain stability when debt becomes unmanageable, not only in extreme situations.

Can bankruptcy stop collection calls immediately?

Yes. Most collection activity must stop once a case is filed.

Choosing the Right Path Forward

Selecting between debt consolidation and bankruptcy requires careful evaluation of debt type, income, assets, and financial goals. What works for one person may be ineffective or harmful for another. Legal guidance helps ensure that decisions are based on facts rather than assumptions.

For individuals in Clearwater seeking reliable guidance from a bankruptcy lawyer, understanding the legal advantages of each option is essential. To explore whether bankruptcy or consolidation better addresses your situation, consult Weller Legal Group.